BTC Future Contango and Bull Spread Arb is back

I wrote previously about future contango. CME only has USD collateral future, (which requires infinite funds to hold the position if bitcoin goes to infinity). Binance offered USD and coin collateral futures, the allowing to short the future while holding a single spot coin, Deribit offered only coin collateral future. FTX offered futures with cross-crypto collateral that would also force infinite collateral call on a short, even if the collateral posted was the coin of the future itself.

With FTX out of the way, Deribit emerges as a winner for futures and options as the volume is much lower binance was lowered (compliance questions). The contango was 3 for a long time, with contango back at 10% for 1Y, and b/o low on options, we consider the following call spread strategy. The order book looks much less liquid for ETH, so we concentrate on BTC for now.

Many futures are no longer there, gone are the days of polkadot contango trades.

Contango: isolate a USD paying more than 10% annual yield until contango convergence:

- long spot btc

- short 1y future

The position is denominated in BTC but riskwise corresponds to a synthetic USD position. This trade is producing USD contango yield as income once the contango converges, which happens at by the maturity of the future.

- long perpetual future

- short 1y future

This created the same position as with spot btc whereas in excess of 10% in USD is expected to be obtained by convergence of the short 1y future, and long perp future, an additional funding leg of the perpetual future needs to be added. We need to do a theoretical and historical analysis to understand the likely perp future cost.

Future Perp Funding

The perp funding is a rather technical subject, see this and this.

The funding rate $f$ for 8 hours is defined as $$ f = \min(\max(\max(P-S/S, 0.025\%) + \min(P-S/S, -0.025\%), -0.5\%), 0.5\%) $$

Where $P$ is the per future price and $S$ is the reference index price. The cost of holding the position 8h might look like reasonable to putting on the trade, but compounding these amounts leads to very high rates for premiums of less than 1%. The annual rate can be computed with $(1+f)^{3 x 365}$.

If touching the $0.5%$ limit for a year, the compound funding rate is 23400%. At most elevated recent level of 0.06%, the compound annual rate is 92%. We get 32% annual funding for 0.026% which is the average last 8 hours of funding rate.

We check the multi year history of perp funding levels on Deribit and see that the pullback mechanism of funding works well: funding is not high, and cumulative funding earned over a long period is nowhere like these extreme values:

Moreover, funding is much lower than any bitcoin market move over a period:

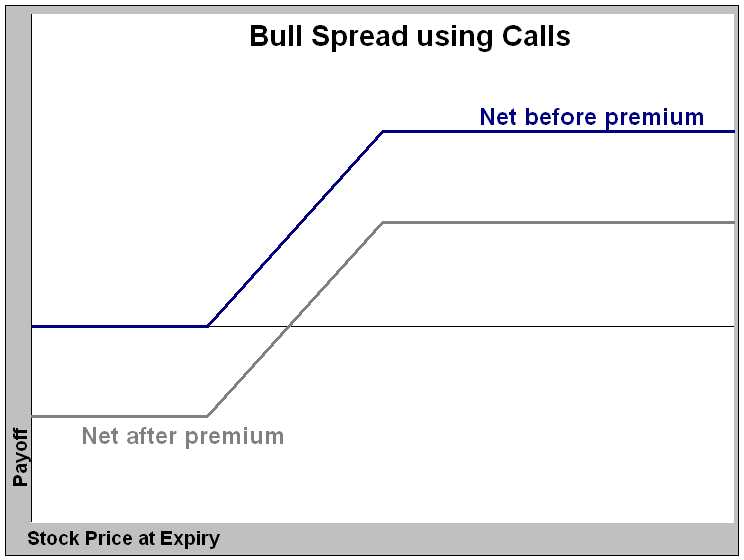

Bull Spread

Bull Spread, $K_1=62k, K_2=80k$

- long put at Spot costs premium -V

- long spot btc or perp future

- short call with premium +V

The whole structure has a btc exposure for up to 1 year for $S \in (K_1,K_2)$ and is flat otherwise in USD. Instead of getting paid 10% in USD - perp funding, the option here distributes a random payoff between 0% and 30%.

While the short BTC future strategy can be unwound as soon as the market turns bearish, the bull spread requires waiting out that the time value of the short call expires, which will likely cary the trade to maturity.

| Tweet |

|