Antonacci's Dual Momentum (part 2/2)

We continue to unpack Antonacci's book.

Crtiical review of MPT

Antonacci reviews standard results: - pioneer was Markowitz (which was all about diversifying), - Sharpe CAPM simplified Markowitz model to a single "market" factor model, and made clarified under what conditions it might be better to leverage a low yield strategy than invest in a higher risk, higher yield strategy. - The EMH was a result of the CAPM model. It says that market are efficient and excess return is explained by risk premia attached to investment in securities with non-diversiable risk (high beta). The theory is confirmed by empirical study showing that high management fee are the best predictors of underperformance, but it attracted some controversy due to its being defended in a dogmatic fashion by some academics. - Fama and French extended the CAPM by adding to the market factor two additional factors: size and value in an attempt to quantify risk premia visible there. - Carhardt added a momentum factor, which has better explanatory power.

While the author is appreciative of that work contribution to diversification. He is critical of the excess of the EMH and the time it took to recognise momentum as a contributor to performance.

Asset Selection

Antonacci reviews various asset classes and strategies:

- equity is the basic portfolio building block it is high risk and he advises to replace the position by bonds when equities crash

- bonds are underperforming assets compared to equity, and he is especially wary of strategies that leverage bonds such as risk parity strategies

- commodities used to be a product where speculators could extract a premium from hedgers, but the market has been crowded by speculators and such premium have dissapeared. He is using the lackluster of CTA index to bear witness to his theory. This applies both to long only and basic trend following strategies.

- smart beta is a very expensive strategy according to him

- hedge funds are charging too much and their return is too low now.

- private equity charges high fees, but does not bring performance.

- ermerging market used to be uncorrelated from developped ones, but this is no longer the case.

All these reasons support his case for his dual momentum strategy.

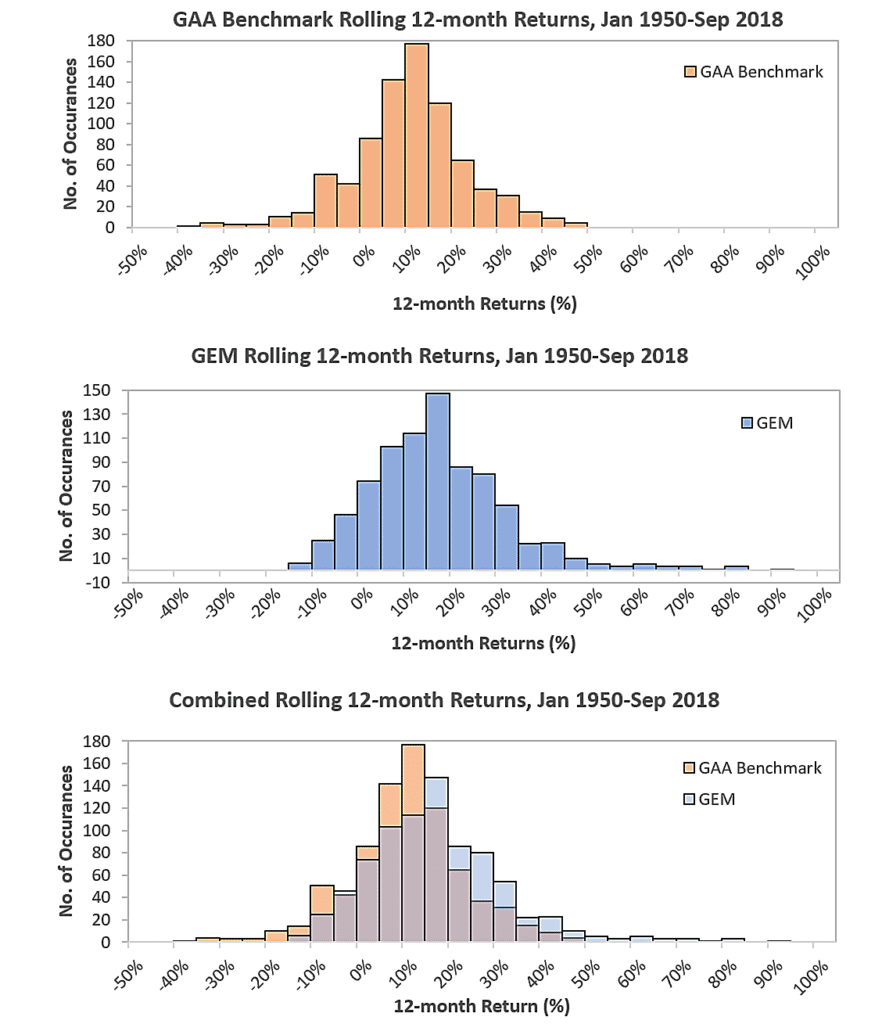

The overperformance of absolute momentum:

As shown on this extended backtesting. Absolute momentum (which is market timing by switching to bonds in the rare instances where market goes below its 200 sma) - improves sharpe ratio dramatically, from 0.5 to nearly 1 - gets rid of much of the drawdown associated with equities, which allows leverage.

| Tweet |

|