Burton Malkiel: A Random Walk Down Wall Street

first posted: 2018-07-29 14:55:08.693028

Burton Malkiel, a princeton scholar made a strong case for index investing in his best selling book published in 1973: A Random Walk Down Wall Street

- he reviews academic research concerning the lack of evidence of performance of technical and fundamental analysis

- makes a case against market timing on the basis that professional managers do not appear to beat the index,

- makes a case against trying to select fund managers or stocks based on their past performance, as studies show that those tend to regress towards the mean

Amidst all the negative exposition, he makes some positive statements:

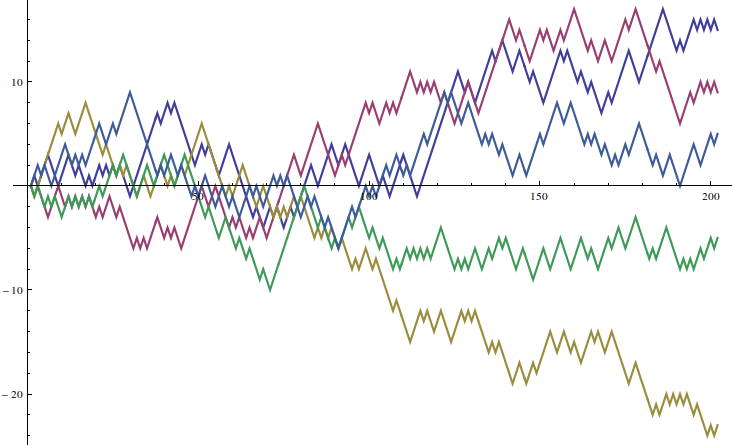

- over the 70+ years, US equities have much better over inflation than bonds and shorter term money market investments, but this comes at the cost of high volatility

- the only free lunch that is consistently exploitable by investors is the benefit of diversification, where increasing the number of holdings (from a handful to 30 stocks) reduces the risk massively and improves compound return assuming similar average return.

- funds management fees are one of the best predictor of future performance.

Based on this evidence, the author advises investors to invest in low cost index funds.

This book transformed the industry in two ways:

- pushing for indexing: it shows the strong empirical evidence case that buying an index fund will result in a better performance than most actively managed mutual funds

- lower the fees: at a time when management was several percent, it explained that fees do matter

| Tweet |

|